The data on the average earnings of doctors in various specialties are based on the officially declared income and recorded expenses specified in the accounting reports of suppliers. They therefore do not include, for example, undeclared income (various fees and gifts without a receipt), and do not exclude the effects of tax optimization by inflating expenses or using company assets for personal consumption. According to a sensitivity analysis, where we proceeded from the theoretical assumption that on average 10% of the costs of materials, services and depreciation (telephone, computer, "educational" trip to the sea in the summer, car) were unlawfully included in the company's expenses, we recalculated the income of doctors and found that the average gross monthly income of a private outpatient doctor in 2017 would have increased by 432 euros to 2848 euros.

Table 1: Gross Salary Equivalent and Other Financial Data Per Physician Position in Common Medical Specialties

(N = 3,771 private outpatient providers – legal entities; 2017)

(source: INEKO)

Data sources: Financial Statement Register, Ministry of Finance of the Slovak Republic (MF SR); health insurance companies

Recalculations and table: INEKO

The highest income (revenue), but also expenses per doctor, are accounted for by gastroenterologists, who require much more complex equipment to perform their work than, for example, psychiatrists. If we exclude clinical speech therapists, who do not need to hire a nurse, psychiatrists have the lowest income and expenses. On average, in 2017, one doctor accounted for about 89 thousand euros in revenue and almost 72 thousand euros in expenses. Between 2014 and 2017, the outpatient clinics’ revenues increased by 18.5%, while expenses grew more slowly, by 15.9%. Thus, the outpatient clinics were profitable.

As for profitability, it should be noted that, unlike most public hospitals, private outpatient medical institutions show a positive financial result on average every year. This applies to all specialties. In 2017, cardiologists had the highest profit after tax, while clinical speech therapists had the lowest. General pediatricians demonstrated the highest net profit margin in 2017, exceeding 20%. Net profit margin reflects the profitability of revenue (profit after tax divided by revenue), and in 2017, the average value for all specialties studied was almost 15%.

The average operating margin, or EBITDA margin, i.e. (earnings before tax + depreciation) / revenue, in 2017 for the studied sample of private outpatient providers - legal entities - was more than 26%. For comparison, the same indicator for the entire Slovak economy in 2013-2016, according to the FinStat portal, was 8.8%.

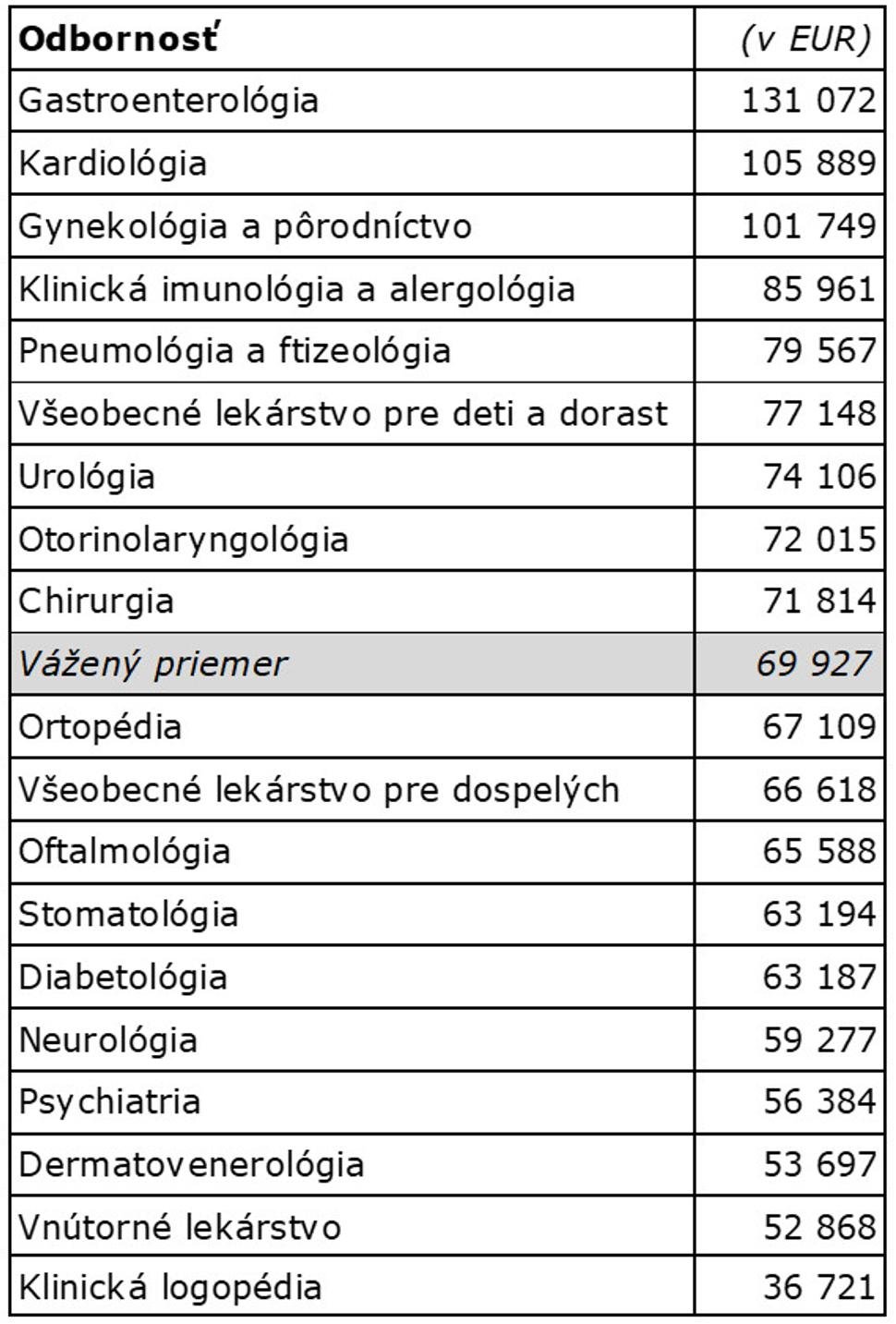

If we look at Table 2 below, we will see the ranking of specialties by the amount of payments from health insurance companies per doctor. All outpatient providers that signed contracts in 2017 are considered, a total of 10,027 entities, regardless of their legal form (i.e., both legal entities (LE) and individuals (IE) together; note: this is a different sample than the one analyzed in Table 1). Health insurers also take into account the specific costs of each specialty when paying for outpatient medical services, including the need for appropriate equipment for outpatient clinics. Therefore, specialties that require a large amount and/or expensive equipment to do their job logically rank first. At the bottom of the table are speech-language pathologists, who do not employ nurses and therefore have lower payments from insurers. Dentists certainly need various equipment, instruments, and medical supplies, but of all the specialties, they also have the largest direct payments from patients, which is why they may not rank higher in Table 2.

Table 2: Average annual revenue from health insurance companies per physician

(N = 10,027, all contracted outpatient providers (LE+FL); 2017)

(source: INEKO)

Data source: health insurance companies VšZP, Dôvera, Union

Table: INEKO

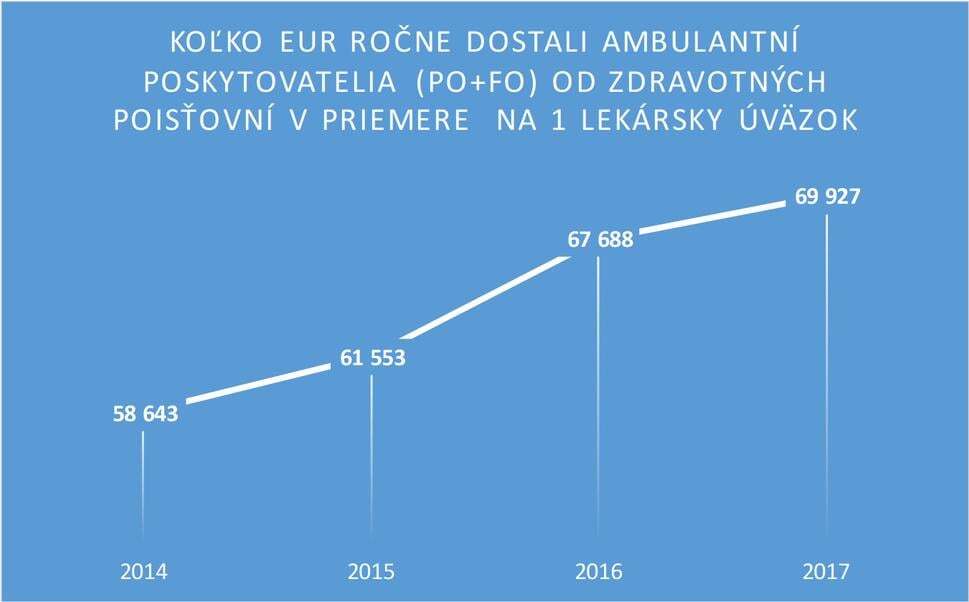

Figure 1: Evolution of annual average private dispensaries' average revenues from health insurance companies, converted per physician rate

(N = 3,771 private outpatient providers - legal entities)

(source: INEKO)

Data source: health insurance companies VšZP, Dôvera, Union

Table: INEKO

Naturally, the actual income of these hospital physicians is higher, as compensation for duty, paid overtime, work on weekends and holidays, as well as the part of the salary above the legal minimum agreed upon during collective bargaining or on the basis of personal salary negotiations with the management of the institution are added to the minimum wage. Unfortunately, publicly available sources, including the Slovak Ministry of Health, do not have data on the average total wages of specialist physicians working in hospitals. Therefore, we can only compare the salaries of all hospital doctors, including those who are unqualified, who earn significantly less than qualified doctors. In 2017, the minimum salary of unqualified doctors was €1,104, which is €927 less than qualified doctors with specialization (note: the term “attestation” was previously used). We therefore have to settle for “only” statistics from the National Center for Health Information (NCZI), which indicates that the average salary for all doctors working in hospital settings (for public interest work), including compensation for on-call work, is just under €2,600 (see Table 3).

Although physician incomes in the private outpatient sector grew twice as fast in percentage terms as the all-hospital physician group during the 2014-2017 period under review, despite this convergence, the average gross salary of hospital-based physicians remains higher (see Table 3 and Chart 2). Of course, for a greater volume of hours worked. To more accurately compare the income of physicians working in private outpatient clinics (all of whom are qualified) and hospital physicians with qualifications, we need to know the salaries of hospital specialists and the actual income of private outpatient physicians, which includes undeclared income and only actually incurred and justified tax expenditures that are used exclusively for business activities and not for personal consumption.

Table 3: Comparison and dynamics of average monthly gross salary

(source: INEKO)

Data sources: Register of Accounts (ÚZ), Ministry of Finance of the Slovak Republic (MF SR); health insurance companies; Union of Health and Social Services (SOZ ZaSS), National Center for Health Information (NCZI); Statistical Office of the Slovak Republic

Conversions and table: INEKO

(source: INEKO)

Data sources: Register of Accounts (ÚZ), Ministry of Finance of the Slovak Republic (MF SR); health insurance companies; Union of Health and Social Services (SOZ ZaSS), National Center for Health Information (NCZI); Statistical Office of the Slovak Republic

Conversions and table: INEKO

(source: INEKO)

Methodology

Data on revenues, expenses, and financial results were obtained from the profit and loss statements of the individual providers listed in the Docket. In order to calculate the gross salary equivalent per physician rate, we needed data from insurance companies on the average number of rates for each specialty for each provider (by CHI identification number). Also, data from the National Center for Health Information (NCZI) Medical Yearbook of Slovakia on the number of nurses working in outpatient clinics for different specialties were used in the calculation. When calculating the cost of nurse labor, we used data from publications of the Statistical Office of Slovakia (ŠÚ SR). There is no data on the wages of nurses in the private outpatient sector, so we used data for all nurses. In 2017, according to the salary structure sample survey, the average gross monthly salary of a nurse in Slovakia was €868. We assumed that in more profitable specialties nurses' salaries would be slightly higher than in less profitable specialties, so in the model we adjusted the average salary costs of nurses in different specialties based on this assumption.The gross wage equivalent of an outpatient physician, whether the physician owns the dispensary or is simply an employee, we have, in simplified terms, calculated as the sum of the physician's gross wages (after deducting nurse labor costs from personal expenses) and the dispensary's profits converted to gross wages. The gross wage equivalent, as well as data on financial result, income and expenses were recalculated and are shown in the tables and graphs per full-time physician.

Dušan Zachar

INEKO

Many thanks to the health insurance companies Všeobecná zdravotná poisťovňa, Dôvera and Union for their cooperation in developing and harmonizing the methodology and providing statistical data for analysis.

This analysis is part of a project supported by the European Social Fund through the Operational Program “Effective Public Administration”.

INEKO implements thei-Health.sk project, which is financially supported by the insurance company Dôvera, and manages the portal nemocnice.ineko.sk, which is financially supported by the insurance companies Dôvera and Union.

If you find INEKO's activities and initiatives useful, we would be very grateful for your support for our further work. Thank you!

- The specialty of physiatry, balneology and medical rehabilitation, which is among the top 20 most common specialties, is not included in the analysis for methodological reasons.

- The term “gross wage equivalent” is explained at the end of the analysis in the Methodology section.

- In order to comprehensively assess the financial health of outpatient providers, a much broader range of financial measures should be considered.

- Martin Vlahinsky: What is the reality of “excessive” network profits; INESS blog; eTREND.sk; 9.8.2018

- Vlahinsky, M. (2018).

- Act No. 578/2004 on health care providers, health professionals, professional organizations in health care: the basic part of the salary of a physician with specialization working in a hospital facility is at least 2.30 times the average monthly wage of a worker in the Slovak economy as established by the Statistical Office of the Slovak Republic for the calendar year preceding by two years the calendar year in which the basic part of the salary is assigned.

- Newsletter of the Slovak Trade Union of Health and Social Services (SOZ ZaSS)

This text is a translation of an article from the website blog.sme.sk

The original text belongs to INEKO, the translation was made with care for foreign doctors by Sofiia Zayka.