The long underfunded health sector, weakened by the pandemic and suffering from understaffing, remains, surprisingly, one of the most lucrative areas for doctors. According to Finstat research, it is general practitioners and subspecialists who earn the most.

Being a general practitioner or pediatrician is not easy. During flu season, waiting rooms are usually full even before the nurse arrives, and sometimes there are only three doctors on duty in emergency departments due to staff shortages. However, this overload, for those who are patient, pays off in the form of higher incomes.

With an aging population, rising incomes, and better informed citizens, healthcare entrepreneurs can rejoice in continued financial growth.

Medical crises also bring steady income to healthcare companies. An example of success during the pandemic in Slovakia can be seen in laboratories, which achieved record profits thanks to mass testing, but the most reliable form of business remains pharmacies.

Being a general practitioner or pediatrician is not easy. During flu season, waiting rooms are usually full even before the nurse arrives, and sometimes there are only three doctors on duty in emergency departments due to staff shortages. However, this overload, for those who are patient, pays off in the form of higher incomes.

With an aging population, rising incomes, and better informed citizens, healthcare entrepreneurs can rejoice in continued financial growth.

Medical crises also bring steady income to healthcare companies. An example of success during the pandemic in Slovakia can be seen in laboratories, which achieved record profits thanks to mass testing, but the most reliable form of business remains pharmacies.

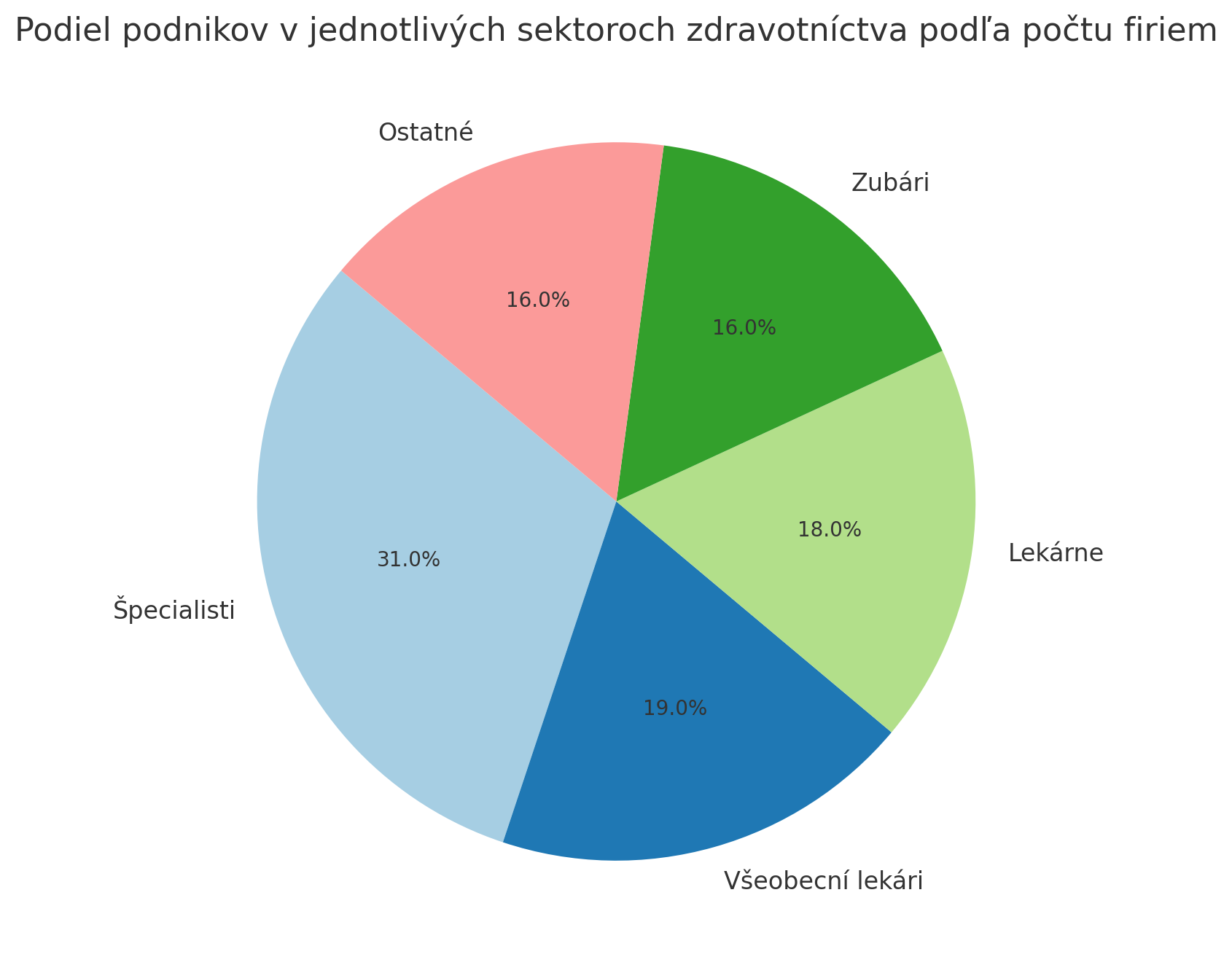

Share of enterprises in selected health sectors by number of companies.

Despite all the challenges, the health sector continues to grow

Health care is one of the few sectors that has not been affected by the pandemic in recent years, but on the contrary, it has helped some of its sectors. It has long been known that the supply of medical services in Slovakia is gradually decreasing, which, willy-nilly, brings better financial results for those who have private medical offices.

The profits of companies in the health care sector have been steadily increasing, except for the pandemic year 2020, when they declined mainly due to losses of sanatoriums in other health care services.

Finstate examined the results of healthcare companies that have already filed their 2023 tax returns. Overall, the data shows that healthcare sector earnings have been rising for the past five years. While in 2019 they were 2.3 billion euros, in 2023 they were already half as high, i.e. 3.4 billion euros.

The increase in revenues is related to the shocks that have affected the healthcare industry in recent years. For example, significant inflation, especially in energy prices, has forced companies to raise the cost of their services and products. Also, the coronavirus pandemic temporarily increased the demand for some types of health services but decreased the demand for others, explained Matej Barta, a medical analyst at the INESS Institute, in an interview for Pravda.

More than 11 thousand companies operate in the healthcare industry, of which more than 62% have already filed tax returns for 2023. Revenues in the industry have grown by half since 2019, to 3.4 billion euros. The total net profit of companies in 2023 amounted to more than 246 million euros, up 17.7 percent compared to last year. General practitioners were the most profitable, with 27 cents of net profit remaining from one euro of revenue. They were followed by specialists and dentists, who have 17 cents of net profit per one euro of income.

The profits of companies in the health care sector have been steadily increasing, except for the pandemic year 2020, when they declined mainly due to losses of sanatoriums in other health care services.

Finstate examined the results of healthcare companies that have already filed their 2023 tax returns. Overall, the data shows that healthcare sector earnings have been rising for the past five years. While in 2019 they were 2.3 billion euros, in 2023 they were already half as high, i.e. 3.4 billion euros.

The increase in revenues is related to the shocks that have affected the healthcare industry in recent years. For example, significant inflation, especially in energy prices, has forced companies to raise the cost of their services and products. Also, the coronavirus pandemic temporarily increased the demand for some types of health services but decreased the demand for others, explained Matej Barta, a medical analyst at the INESS Institute, in an interview for Pravda.

More than 11 thousand companies operate in the healthcare industry, of which more than 62% have already filed tax returns for 2023. Revenues in the industry have grown by half since 2019, to 3.4 billion euros. The total net profit of companies in 2023 amounted to more than 246 million euros, up 17.7 percent compared to last year. General practitioners were the most profitable, with 27 cents of net profit remaining from one euro of revenue. They were followed by specialists and dentists, who have 17 cents of net profit per one euro of income.

The most profitable specialists and general practitioners

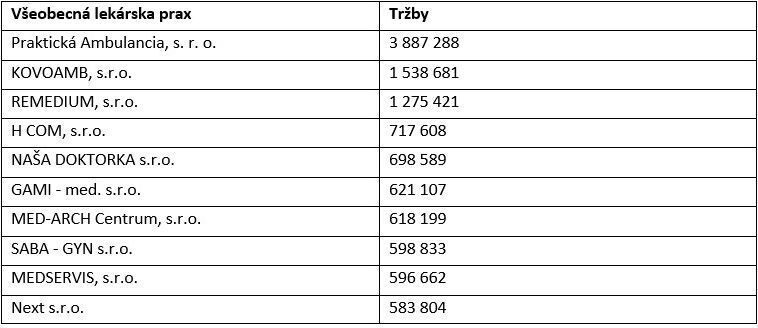

The undisputed leaders in health care remain doctors, particularly adult general practitioners and pediatricians, specialists and dentists. Over the past five years, general practitioners' income has grown at an average annual rate of seven percent. Just like revenues, net income for outpatient clinics has increased nearly every year for the past five years.

“On the other hand, revenue growth is also supported by long-term trends that healthcare will continue to face in the coming years. The main ones are the aging population, growing wealth and better informed citizens, which increases demand,” said Barta.

How profitable is it to be a general practitioner? Matej Barta explains that it is important to understand the context. If a general practitioner or pediatrician works in a hospital, he receives a fixed monthly salary. And if he runs a private practice, his income depends on several factors. On the one hand, there is the revenue, which depends on the patient fee (capitation) and various bonuses for services rendered. On the other hand are expenses, including rent, utilities, nurse's salary, office equipment, and more. Barta also notes that in the case of private offices, profits can be highly dependent on how income is distributed. For example, if a doctor officially assigns himself a minimum wage, the profit of his office will look much higher. According to him, the financial results of outpatient clinics can be distorted by such accounting approaches.

Whether it's worth it to be one type of doctor or another depends on many factors, and Barta emphasized that it's impossible to give a definite yes or no answer. “In addition to the income and cost factors mentioned, personal preferences can also influence the decision. One physician may prefer the certain degree of freedom that private practice affords him or her, while another may prefer a stable salary and 'set' conditions in exchange for not having to deal with office management. This is just one example, and there could be many more factors influencing the decision,” he added.

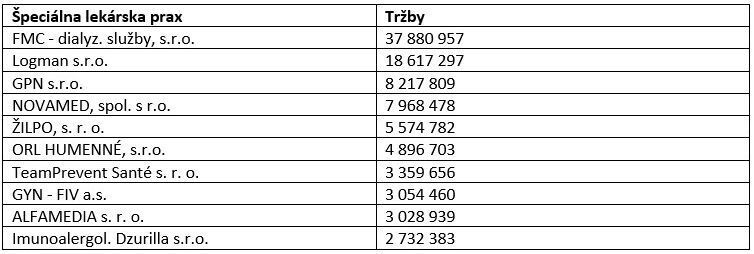

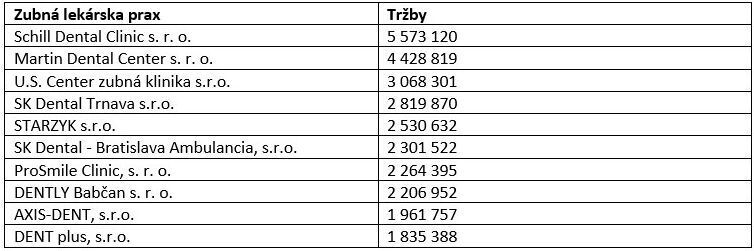

Companies that manage general outpatient clinics have the lowest debt levels (ratio of liabilities to total assets) among the six healthcare sectors analyzed. In 2023, their debt was 23.5%. By comparison, specialists had a ratio of around 31% and dentists had a ratio of over 40%. Among specialty companies, the largest in terms of revenue are those engaged in specialized medical practices. The revenue leader among them is FMC - Dialyzačné služby, s.r.o., 94.8% of which is owned by the German company Fresenius Medical Care Beteiligungsgesellschaft mbH. Last year, the company achieved revenues of almost 38 million euros and made a profit of 154 thousand euros for the first time since 2017.

The second largest company in terms of revenue is Longman s.r.o., which also operated dialysis centers, mainly in eastern Slovakia. Its revenue last year was €18.6 million, but as of January 1, 2024, the company was liquidated and merged with FMC - Dialyzačné služby. The successor to the company had previously absorbed several firms in the dialysis services sector. The top three also include the operator of the famous Koch Sanatorium in Bratislava, GPN s.r.o., with revenues of EUR 8.2 million. GPN's majority shareholder is Ivan Kmotrik, who also owns the soccer club ŠK Slovan Bratislava.

“On the other hand, revenue growth is also supported by long-term trends that healthcare will continue to face in the coming years. The main ones are the aging population, growing wealth and better informed citizens, which increases demand,” said Barta.

How profitable is it to be a general practitioner? Matej Barta explains that it is important to understand the context. If a general practitioner or pediatrician works in a hospital, he receives a fixed monthly salary. And if he runs a private practice, his income depends on several factors. On the one hand, there is the revenue, which depends on the patient fee (capitation) and various bonuses for services rendered. On the other hand are expenses, including rent, utilities, nurse's salary, office equipment, and more. Barta also notes that in the case of private offices, profits can be highly dependent on how income is distributed. For example, if a doctor officially assigns himself a minimum wage, the profit of his office will look much higher. According to him, the financial results of outpatient clinics can be distorted by such accounting approaches.

Whether it's worth it to be one type of doctor or another depends on many factors, and Barta emphasized that it's impossible to give a definite yes or no answer. “In addition to the income and cost factors mentioned, personal preferences can also influence the decision. One physician may prefer the certain degree of freedom that private practice affords him or her, while another may prefer a stable salary and 'set' conditions in exchange for not having to deal with office management. This is just one example, and there could be many more factors influencing the decision,” he added.

Companies that manage general outpatient clinics have the lowest debt levels (ratio of liabilities to total assets) among the six healthcare sectors analyzed. In 2023, their debt was 23.5%. By comparison, specialists had a ratio of around 31% and dentists had a ratio of over 40%. Among specialty companies, the largest in terms of revenue are those engaged in specialized medical practices. The revenue leader among them is FMC - Dialyzačné služby, s.r.o., 94.8% of which is owned by the German company Fresenius Medical Care Beteiligungsgesellschaft mbH. Last year, the company achieved revenues of almost 38 million euros and made a profit of 154 thousand euros for the first time since 2017.

The second largest company in terms of revenue is Longman s.r.o., which also operated dialysis centers, mainly in eastern Slovakia. Its revenue last year was €18.6 million, but as of January 1, 2024, the company was liquidated and merged with FMC - Dialyzačné služby. The successor to the company had previously absorbed several firms in the dialysis services sector. The top three also include the operator of the famous Koch Sanatorium in Bratislava, GPN s.r.o., with revenues of EUR 8.2 million. GPN's majority shareholder is Ivan Kmotrik, who also owns the soccer club ŠK Slovan Bratislava.

Revenue of the top 10 companies in the field of general, specialized and dental medical practice in 2023 (euros)

Laboratories and the pandemic

The imaginary winner of the pandemic is the laboratory sector, with revenue increasing by 18% in 2020 and another 50% in 2021. And these figures apply only to the top five companies, with Unilabs Slovensko leading the way. In 2023, the company's revenue reached almost 80 million euros, representing 85% of the sector's total revenue.

A larger player is Medirex, which, however, has not yet filed its tax return for 2023 and is therefore not included in this analysis.

A larger player is Medirex, which, however, has not yet filed its tax return for 2023 and is therefore not included in this analysis.

Contribution to the opening of new outpatient clinic

New outpatient clinics are to be opened in Slovakia. Adult general practitioners and pediatricians can apply for financial assistance under the Recovery and Sustainability Plan, receiving up to €80,000 for the establishment of new medical facilities. In this way, the Ministry of Health seeks to provide medical personnel to regions experiencing a shortage of them.

In the Považska-Bistrica region, the situation with the shortage of general practitioners for adults and children has been critical for a long time. One pediatrician and up to four general practitioners can open a new office in this region with the help of funds from the recovery plan.

The first application of the recovery plan created 22 new outpatient clinics. Of these, 15 were for adults and 7 for children. There are currently 47 successful applicants in the second round.

In the Považska-Bistrica region, the situation with the shortage of general practitioners for adults and children has been critical for a long time. One pediatrician and up to four general practitioners can open a new office in this region with the help of funds from the recovery plan.

The first application of the recovery plan created 22 new outpatient clinics. Of these, 15 were for adults and 7 for children. There are currently 47 successful applicants in the second round.

Pharmacy profits have been growing for a long time

Pharmacies have the largest share of revenue among the six industries analyzed, and this has long been more than 40 percent. Significantly behind them are the activities of specialized medical practices with a share of more than 14 percent. The remaining activities have a smaller share of revenue.

The pharmacy business, along with general medical practice, appears to be the most stable among the six industries analyzed. Average revenue growth over the five years was more than eight percent, and in no year did pharmacy revenue decline. In 2023, almost 1,300 companies in this sector will reach revenues of 1.4 billion euros.

Among pharmacies, the largest player in the market is the Dr. Max network, which unites about two hundred limited liability companies. The most important of them is the central company Dr. Max, owned by Penta Financial Group. In 2023, the pharmacy chain achieved revenues of more than 35 million euros. In total, pharmacies under the Dr. Max brand earned around 300 million euros, representing almost 21% of the sector's total revenue.

Similar to the Dr. Max chain of pharmacies is the Benu chain of pharmacies, which includes about 150 companies, of which about thirty filed tax returns for 2023, with a combined revenue of less than 50 million euros. Also a significant player in the sector is Pilulka.sk, a. s., which is primarily focused on online sales but has not yet filed a tax return for 2023.

“When considering pharmacies, one should also take into account the fact that their assortment is in some cases gradually expanding to less traditional products for pharmacies, from diapers to electronics. Sales of these items may have some impact on revenue and profitability,” said analyst Barta.

The pharmacy business, along with general medical practice, appears to be the most stable among the six industries analyzed. Average revenue growth over the five years was more than eight percent, and in no year did pharmacy revenue decline. In 2023, almost 1,300 companies in this sector will reach revenues of 1.4 billion euros.

Among pharmacies, the largest player in the market is the Dr. Max network, which unites about two hundred limited liability companies. The most important of them is the central company Dr. Max, owned by Penta Financial Group. In 2023, the pharmacy chain achieved revenues of more than 35 million euros. In total, pharmacies under the Dr. Max brand earned around 300 million euros, representing almost 21% of the sector's total revenue.

Similar to the Dr. Max chain of pharmacies is the Benu chain of pharmacies, which includes about 150 companies, of which about thirty filed tax returns for 2023, with a combined revenue of less than 50 million euros. Also a significant player in the sector is Pilulka.sk, a. s., which is primarily focused on online sales but has not yet filed a tax return for 2023.

“When considering pharmacies, one should also take into account the fact that their assortment is in some cases gradually expanding to less traditional products for pharmacies, from diapers to electronics. Sales of these items may have some impact on revenue and profitability,” said analyst Barta.

This text is a translation of an article from spravy.pravda.sk (original material),

translated with attention to detail for the convenience of foreign readers

by Sofia Zayka.